SERS vs VERS: What Your HDB Plan Should Be Now (From An Agent’s Perspective)

1 September 2025

Introduction

In 2017, then-Minister for National Development Lawrence Wong (now Singapore’s Prime Minister) first cautioned against buyers paying high prices for older flats in anticipation of a SERS windfall. He urged Singaporeans to recognise that all leases inevitably decay, advising younger buyers, in particular, to choose flats with leases that would cover them until at least age 95.

Recently, Minister Chee Hong Tat’s comments on the Voluntary Early Redevelopment Scheme (VERS) have revived anxiety among homeowners in older estates. While the public discussion has focused on policy mechanics, homeowners are left with pressing personal questions: What does this mean for my flat’s value now? Should I sell, stay, or rent it out?

Many still cling to the outdated dream of a SERS payout—a dangerous misconception that could jeopardize their retirement plans. This article cuts through the noise to provide a clear framework, including strategies for managing ABSD and lease decay, to help you make the most informed decision for your future.

Quick Explanation on Selective En bloc Redevelopment Scheme (SERS)

The selective En bloc redevelopment scheme was originally strategy to revitalize older HDB estates and optime land use. It offers residents opportunity to move to newer and modern flats with fresh lease often within the precent . The residents will receive compensation base on the market value and often given extra perks such as removal allowance, reimbursement of stamp and legal fee on the replacement flat, waiver of levy or even special support with defer resale levy for those who sold a subsides flat.

Why You Should Stop Betting On The SERS MYTH

SERS wasn’t just about compensation; it was a perfect alignment of factors:

1. Land Scarcity & Urban Planning

The government identified towns with immense potential for higher density (e.g., more MRT lines, new town centres). Your block was in the right place at the right time.

2. Strong Fiscal Position

The state had the capacity to offer generous packages to accelerate this urban renewal.

3. The “SERS Premium”

Flats in potential SERS sites often traded at a slight premium due to speculation. However, buying hoping for SERS was always a high-risk

gamble.

The Key Takeaway

SERS was always intended as a selective redevelopment tool, not a guaranteed outcome for every flat. Relying on it as a retirement plan carries significant risks.

The Introduction of Voluntary Eary Redevelopment Scheme (VERS)

The Voluntary Eary Redevelopment Scheme (VERS) was first announced in 2018, where government initiative addressing the issues of aging HDB flats and their expiring 99 year leases particular in 2070s and 2080s.

This initiative is somehow different from SERS whereby VERS allows residents of selected older precincts to vote on whether the Government should buy back their flats for redevelopment. The compensation were be expected lower and VERs requires resident approval.

What VERS Really Means for Your Flat’s Value

Think of VERS not as a lottery, but as a structured end-of-life plan for your estate. From a property value standpoint, here’s what it means:

I. The 70-Year Threshold

The offer comes when the estate is ~70 years old. With a 99-year lease, this leaves roughly 30 years unexpired. This is crucial for valuation.

II. Compensation Clarity

The government has stated compensation will be “less generous.” We can infer it will be based on the as-is market value of a 70-year-old flat, not the value of a prime site with redevelopment potential. This value will be significantly lower than peak value.

III. The Voting Hurdle

Requiring a high vote percentage (likely 75-80%) adds uncertainty. What if your neighbours disagree? Your exit strategy is now dependent on collective decision-making.

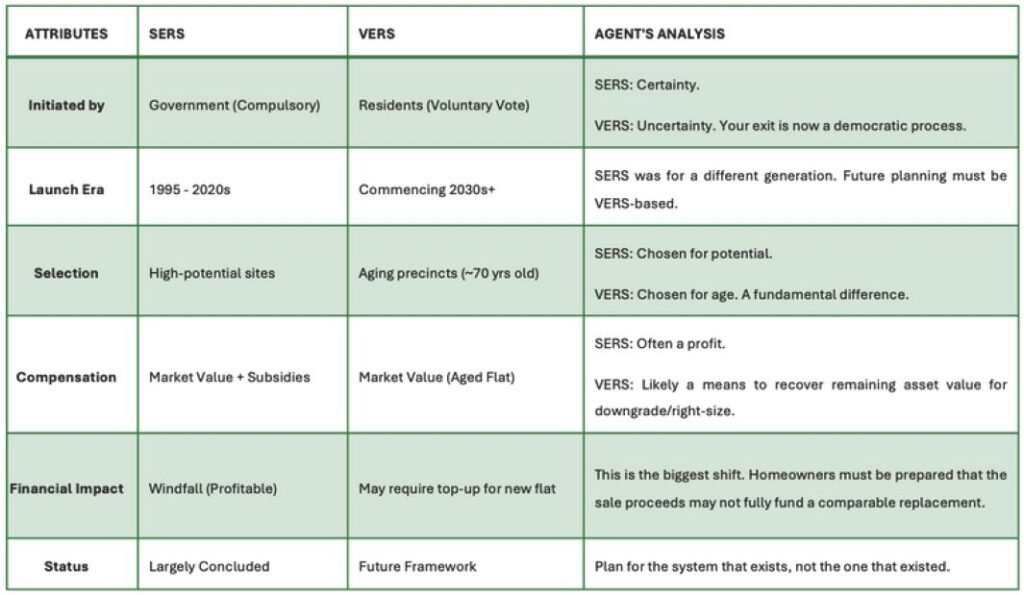

Table 1: Summary of Key differences And Critical Analysis between SERS and VERS

What Should an HDB Owner Do Now?

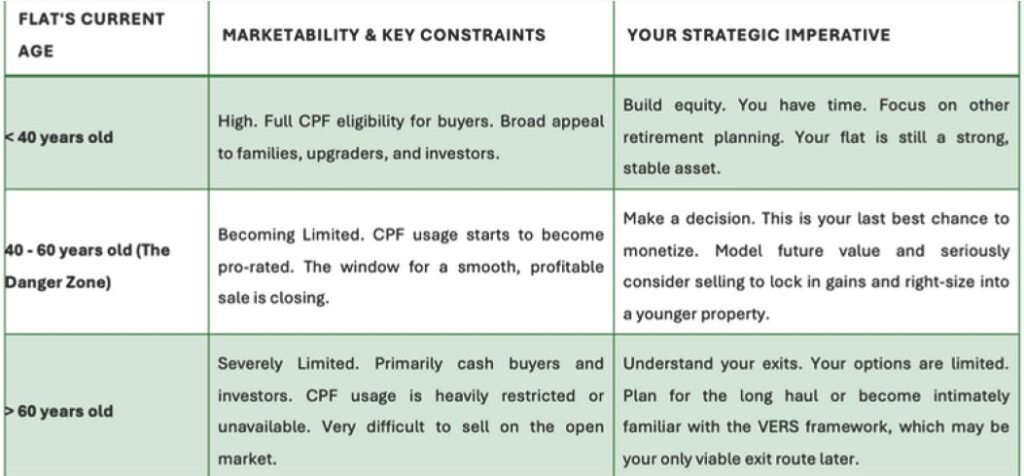

“Your Flat’s Age Decides Your Strategy”

The value of your leasehold property doesn’t decline evenly. Once the remaining lease dips below 60 years, the decay accelerates rapidly. Your action plan depends entirely on which phase your asset is in.

Build a Holistic Retirement Plan (Your HDB is Just One Piece)

Your HDB should not be your only retirement asset. A professional financial plan diversifies risk.

The “Monetise Now” Strategy

Sell your older flat at a price the market will pay today (which still factors in its long lease). Use the proceeds to buy a smaller, newer flat (e.g. a 2-room Flexi with a short lease for your needs) and invest the leftover capital.

The “Ride it Out” Strategy

If you plan to stay indefinitely, understand that the asset value will likely decline. Ensure you have other savings (CPF, investments) to support you, VERS then becomes a potential option to unlock your remaining asset value later.

The “Rental Cash Flow” Strategy (A Landlord’s Calculus)

For some owners, particularly those who have moved to private property and can therefore rent out their entire HDB flat, there’s a third path; becoming a long-term landlord to generate passive income. Let’s break down the numbers with a realistic example, as this is a pure financial decision.

The Scenario

You own a 3-room HDB in Ang Mo Kio (built ~1978, ~50 years old today). You bought it 10 years ago for $350,000. You now collect $3,000/month in rent ($36,000 annually).

Option A: Sell Now

The current market value is approximately $480,000. After paying off your remaining mortgage and costs, you walk away with a substantial cash profit.

Option B: Hold and Rent for 10 Years

Let’s project the financials:

- Total Gross Rental Income: $3,000 x 12 months x 10 years = $360,000

- Estimated Costs (25%): Maintenance, higher property tax (for non-owner-occupied), agent fees, potential vacancy, and repairs. $360,000 x 0.25 = $90,000

- Net Rental Profit: $360,000 – $90,000 = $270,000

Future Flat Value in 10 Years: The Great Unknown.

This is the single biggest factor.

There are two competing forces:

1. Lease Decay:

The flat will be 60 years old. The remaining lease (39 years) will severely restrict the pool of buyers who can use CPF. This creates powerful downward pressure on price.

2. Inflation & Market Forces:

General inflation and long-term housing demand may create upward pressure on all property prices.

Therefore, the Total Projected Value in 10 Years is a range of realistic scenarios:

Conservative Scenario (Lease Decay Wins)

Conservative Scenario (Lease Decay Wins)

The flat’s value drops to $300,000.

- Total Projected Value: Net Rental Profit ($270,000) + Future Value ($300,000) = $570,000

Optimistic Scenario (Inflation Wins)

Assume the nominal price holds steady at $480,000.

- Total Projected Value: Net Rental Profit ($270,000) + Future Value ($480,000) = $750,000

- However, it’s crucial to understand that $480,000 in 2034 dollars will have much less purchasing power than it does today. In real terms, you have likely still experienced a capital loss.

The Critical ABSD Caveat for Option A (Selling and Upgrading)

For many owners, the logical next step after cashing out $480,000 is to consider reinvesting in another property, often a private condo. However, this path is fraught with a massive financial hurdle: the Additional Buyer’s Stamp Duty (ABSD).

As a Singaporean, buying your second residential property now comes with a 20% ABSD on the purchase price or market value, whichever is higher.

Let’s revisit the math for Option A, but now with the intent to buy a $1.2 million condo:

- Cash Proceeds from HDB Sale – $480,000 (after mortgage)

- ABSD Payable on a $1.2M Condo – 20% x $1,200,000 = $240,000

- Net Cash Left After ABSD- $480,000 – $240,000 = $240,000

Suddenly, that $480,000 profit is cut in half before you even pay the downpayment for the new condo. This $240,000 ABSD bill effectively burns through your profits and dramatically alters the calculus.

Option A (Sell and Reinvest)

You now have $240,000 in cash (plus whatever you have for a downpayment) but are taking on a new, large mortgage for the condo.

Option B (Hold and Rent)

You have a projected $570,000 in future value (rental profit + asset value) without a new mortgage. This doesn’t automatically make Option B better, but it makes the decision incredibly complex. The “right” choice now depends on:

- Your Cash Reserves:

Do you have enough spare cash on top of your sale proceeds to pay the ABSD withou wiping out your entire profit? - Investment Alternatives:

Would that $480,000 be better deployed in other hiugher-yiedling investments (stocks, bonds, REITs) rather than sinking a huge chunk of it into tax. - Risk Appetite:

Are you willing to accept the risks of being a landlord to avoid this massive tax event.

The Owner-Occupier’s Dilemma: Is Waiting for VERS a Viable Upgrade Strategy?

For many homeowners, the dream isn’t just about investment returns; it’s about the hope that VERS will be the key that unlocks the door to a newer, better home. This vision of using a future compensation package to upgrade is a powerful one, but it is a path fraught with financial complexities that demand a realistic assessment.

The cornerstone of this dilemma lies in understanding the fundamental math of leasehold valuation. As guided by the Singapore Land Authority’s models, a property’s value is intrinsically linked to its remaining lease. A stark benchmark reveals that a 20-year leasehold property is valued at roughly half that of a 99-year leasehold property. When the government offers VERS for a precinct, the compensation is based on the fair market value of a flat that is, by that point, approximately 70 years old. While this is a fair valuation for an aging asset, it is crucial to recognize that this sum represents a fraction of the cost of a new flat with a fresh 99-year lease. The additional support for removal costs and stamp duties, while helpful for managing transaction fees, does little to bridge this significant value gap.

This financial reality collides head-on with another unavoidable constraint: financing. Consider a homeowner in their fifties, the typical age for someone in a mature estate. When VERS is eventually offered, banks will assess their loan application based on a maximum loan age limit, typically capping the tenure at age 65. This drastically shortens the eligible loan period, which in turn inflates the monthly mortgage repayment. The resulting strain on the Mortgage Servicing Ratio (MSR) can make servicing a large loan for a new property a prohibitive financial burden for those on the cusp of retirement.

It is important to note that under the VERS framework, the government may offer residents the option to purchase a replacement flat with a shorter lease, typically between 15 to 45 years, at a subsidised rate. This is designed to provide a more affordable path to a newer home without a significant financial top-up. However, this option requires careful consideration. While it solves the immediate affordability issue, you are essentially using your compensation to secure another leasehold asset that will, once again, face the same inevitable decay in value. The question becomes whether this constitutes a true “upgrade” or a lateral move into a newer building, but with a similarly finite asset lifespan.

Therefore, the critical question for the owner-occupier is not merely whether to wait for VERS, but to quantify the opportunity cost of waiting. Selling the flat today on the open market, while it still holds a 40- or 50-year lease, could yield a substantially higher sum than a future VERS payout for a 70-yearold flat. This present-day capital could provide far greater flexibility and security, whether for retirement income or a planned downgrade on your own terms.

Ultimately, the decision to wait for VERS or to act on current market conditions is a highly personal one, contingent on individual financial circumstances and retirement goals. While VERS presents a structured option for the future, including the possibility of a subsidised replacement flat, a comprehensive financial plan should consider all available pathways. For many owner-occupiers, a thorough evaluation of the property’s value today—compared to the projected outcomes of a future VERS offer—provides the most grounded foundation for deciding whether to monetise the asset now or to hold for the longer term. Prudent planning, based on a clear understanding of both market principles and one’s own financial capacity, remains the most critical step for any homeowner navigating this complex landscape.

Conclusion

The journey from SERS to VERS marks a fundamental shift in how we must view our HDB flats. The conversation needs to move away from hoping for a government-backed lottery ticket and toward the disciplined management of a critical financial asset.

Your HDB is not a passive investment. It is a depreciating leasehold asset, and its strategy is dictated by one non-negotiable factor: the ticking clock of its 99-year lease. The paths we’ve outlined—selling to monetize, renting for cash flow, or staying put—are conscious decisions about how you want this asset to serve you in its remaining lifespan.

For owner-occupiers, the calculations are particularly profound. While VERS may offer a future option for a subsidised replacement flat, the core financial equation remains: the compensation for a 70-year old asset is fundamentally different from the value of a young lease. Coupled with the financing constraints that come with age, this means waiting for VERS is rarely a straightforward upgrade path. It often leads to a lateral move or a difficult downsizing decision.

Furthermore, broader market realities like the Additional Buyer’s Stamp Duty (ABSD) significantly alter the financial calculus of upgrading to private property, making a careful assessment of all your options not just wise, but necessary. In essence, this isn’t just about property—it’s about preparedness over uncertainty, and planning over passivity. The most empowering step you can take is to build a robust, personal financial plan based on current realities and your individual goals.

Therefore, we encourage you to start that planning today. By taking a proactive and informed approach, you can navigate the future from a position of confidence and security, fully prepared for whatever opportunities may arise.