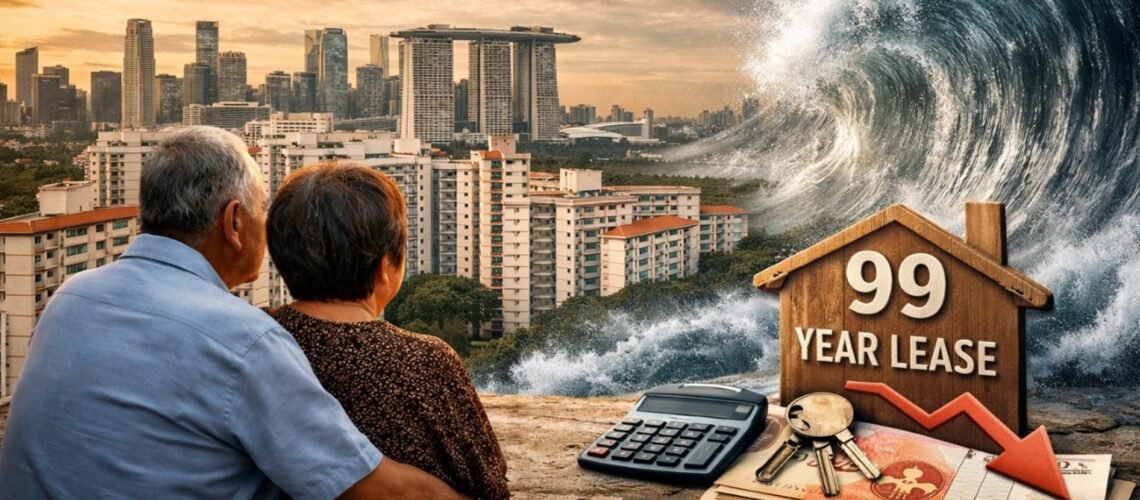

The Silver Tsunami and the Real Estate Conundrum

12 January 2026

By 2030, one in four Singaporeans will be aged 65 or older. This “Silver Tsunami” isn’t just a social issue — it’s reshaping HDB values, buyer demand, and exit timing in ways many owners underestimate.

Here’s the key reality:

HDB flats don’t lose value gradually. They drop in stages.

Why? Because younger buyers — the strongest and most liquid buyer pool — can only fully use CPF and secure maximum loans if a flat’s remaining lease covers them until at least age 95. Once a flat slips below key lease thresholds, demand narrows sharply, financing tightens, and prices face resistance.

- For homeowners, this raises an uncomfortable question: Will your flat still work for you financially when you need it most?

- For investors, the risk is just as real. Holding an ageing lease for “one more cycle” can turn a liquid asset into a slow, price-sensitive one — especially in estates without strong healthcare and senior infrastructure.

At the same time, longer lifespans and rising medical costs mean housing is no longer just a wealth asset. It has become a wellness asset — one that must support mobility, care access, and financial independence for decades.

The full article explores:

Why lease decay is colliding with longevity

How ageing-in-place, senior housing, and cross-border options are reshaping demand

Why location is being redefined by access to healthcare and community support

What smart owners are doing before financing and buyer pools shrink

The Silver Tsunami isn’t a sudden crash. It’s a slow, powerful shift.

Those who plan early keep options. Those who wait may find choices narrowing.

Read the full article to understand the timelines, rules, and strategies that could shape your retirement:👉 The Silver Tsunami and the Real Estate Conundrum-Article-6